Investors hoping to build their portfolios face a 3% surcharge on Stamp Duty Land Tax on properties bought for rental or as a second home. The extra tax will come into effect in April 2016.

Landlords were already coming to terms with tax changes which will stop them deducting the cost of mortgage interest from their rental income when calculating profit – and will restrict tax relief on mortgage interest to 20% by 6 April 2020.

This means that higher rate taxpayers with large mortgages will pay substantially more tax. Some could find the tax rate rises above 100%. Even basic rate taxpayers will be affected.

To make matters worse, the automatic right for landlords of furnished property to claim a 10% wear and tear allowance is being scrapped – from April 2016 they will only be able to deduct costs they incur based on actual expenditure.

However, all is not lost. The new rules will apply to individuals, partnerships and trusts. Companies are excluded from the provisions and this offers a solution.

Some landlords who let a number of properties have the option of transferring their properties to a limited company, free of significant tax charges, if they manage their property portfolio as a business.

Company profits are taxed at corporation tax rates (currently 20%, reducing to 18%) rather than income tax rates (up to 45%), leaving more funds to finance acquisitions and grow the

property portfolio.

Landlords letting commercial property and qualifying furnished holiday accommodation are also not affected. Whatever your situation, now is the time to do the review your portfollio and weigh up the options.

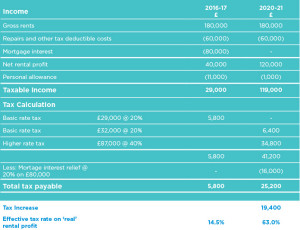

Let’s take a closer look at the effect of the changes on a basic rate taxpayer (assuming the taxpayer has no other income).

2016-17 will be the final tax year in which the mortgage interest is deductible in full. In the example below, that results in a taxable income of £29,000, which falls within the 20% tax band.

By 2020-21 the impact of the new rules will be fully felt, resulting in a tax increase of £19,400 (assuming all other things being equal). The mortgage interest will no longer be deductible from the rental income – instead 20% relief of £16,000 is given as a deduction against the tax.

The effect is to push income into the higher rate tax bracket and leads to a withdrawal of the personal allowance as income exceeds £100,000. Recipients of child benefit and tax credits will also be affected.

It is disturbing that the effective rate of tax will increase to 63% of the ‘real’ rental profit (£25,200/£40,000) when the changes are fully implemented.

For larger property portfolios with high borrowings, the position is even more dramatic. Consider the following property business run by a married couple in partnership (again assuming no other income).

In this example the tax increase is a staggering £76,600, resulting in a tax charge of £82,200 or 164.4% of the ‘real’ rental profit. This could put these landlords out of business.

Even more astonishing, is that some landlords will be forced to pay tax when they have made a loss, perhaps due to difficulties in finding a tenant or as a result of facing unexpected repair bills.

The restriction of interest relief is only aimed at landlords of residential property, but landlords of commercial property can also benefit from significant tax savings by operating through a company.

The main stumbling block is that current finance will need to be renegotiated. Current lenders need to be consulted early to discuss potential refinancing costs.

We would encourage landlords to review their options now as the tax break on incorporation may be short lived.

To find out more about the services that we offer, visit our Services page. Alternatively, if you would like further information on the issues raised above, please contact us using our contact page.